when are property taxes due in chicago illinois

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. Passing Amendment 1 would lead to higher property taxes in Illinois with the increase conservatively estimated at 2149 for the typical household.

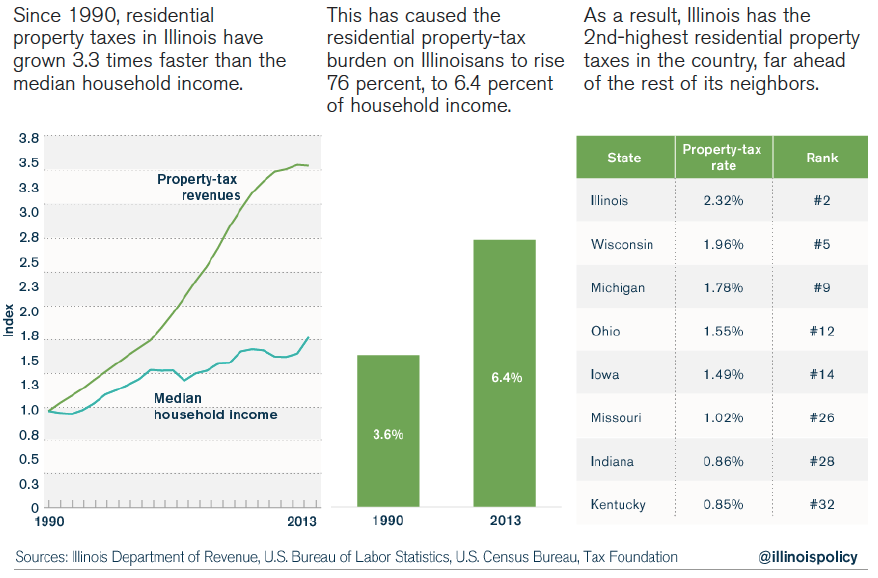

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet.

. Tax Extension and Rates The Clerks Tax Extension Unit is responsible for calculating property tax rates for all local taxing. September 9 2021 Cook County Treasurer Maria Pappas and her office have sent out the second property tax bill installment which is due October 1. Because of its proximity to some of Chicagos western suburbs the county is required to pay 6450 in property taxes each year.

Check to see if your taxes are past due. The first installment is due on March 1st and covers taxes from the previous year. Tax Year 2021 First Installment Due Date.

In most counties property taxes are paid in two installments usually June 1 and September 1. Cook County Board President Toni Preckwinkles office told the I-Team exclusively it will introduce an amendment at the next board meeting which would officially delay property. Tax amount varies by county.

Accorded by Illinois law the government of Chicago public. Friday October 1 2021 Tax Year 2020 First Installment Due. To be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500000 or less if filing jointly.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. The second installment is due on September 1st and covers taxes from the current year. The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system.

In Chicago property taxes have grown more than 3 times faster than inflation for 20 years. 2 days agoYou were an Illinois resident in 2021 and your adjusted gross income on your 2021 Form IL-1040 is under 400000 if filing jointly or under 200000 if youre filing as a single. 14 hours agoFor couples who file jointly for tax year 2023 the standard deduction increases to 27700 up 1800 from tax year 2022 the IRS announced.

Restaurant Tax guidance for. Tuesday March 1 2022 Tax Year 2020 Second Installment Due Date. WTTW News Private investors are exploiting an arcane Illinois law to profit from the property tax debt owed on thousands of.

Single taxpayers and married. This estimate is based. The income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to receive a total of 100 Mendozas office said in a news release.

MyDec at MyTax Illinois - used by individuals title companies and settlement agencies to submit approve or reject Real Property Transfer Tax Declarations replaces the. Tax Due Dates Extended Due To Covid-19. March 1 2021 Cook Countys first property tax payments are due March 2.

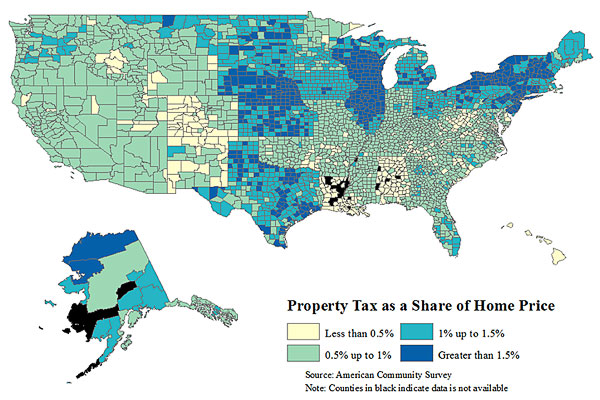

10 hours agoA residential street in Wicker Park in Chicago. There are three basic phases in taxing real estate ie setting levy rates estimating property values and receiving payments. Illinois Property Tax Rates By Town.

Property Tax 101 An overview of the Illinois Property Tax system. Odds are growing that the due date on 16 billion in Cook County property tax bills will be Dec. Youll likely get your property tax bill this yearbut only barely.

If you have delinquent taxes for Tax Year 2020 they will be offered at the 2020 Annual Tax Sale which begins November 15 2022. Late payments will be. For more information about taxes in Chicago you may visit the Tax Division of the.

The Portal consolidates information and delivers. 173 of home value.

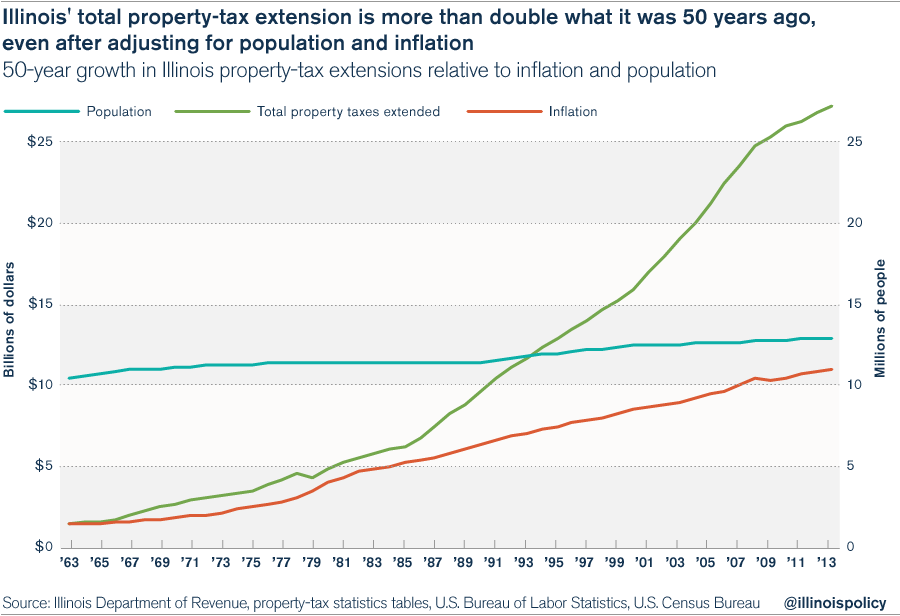

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy

Dupage County Residents Pay Some Of The Nation S Highest Property Tax Rates

Study Illinois Property Taxes Still Second Highest In Nation

Town Hall Focuses On Illinois High Property Taxes

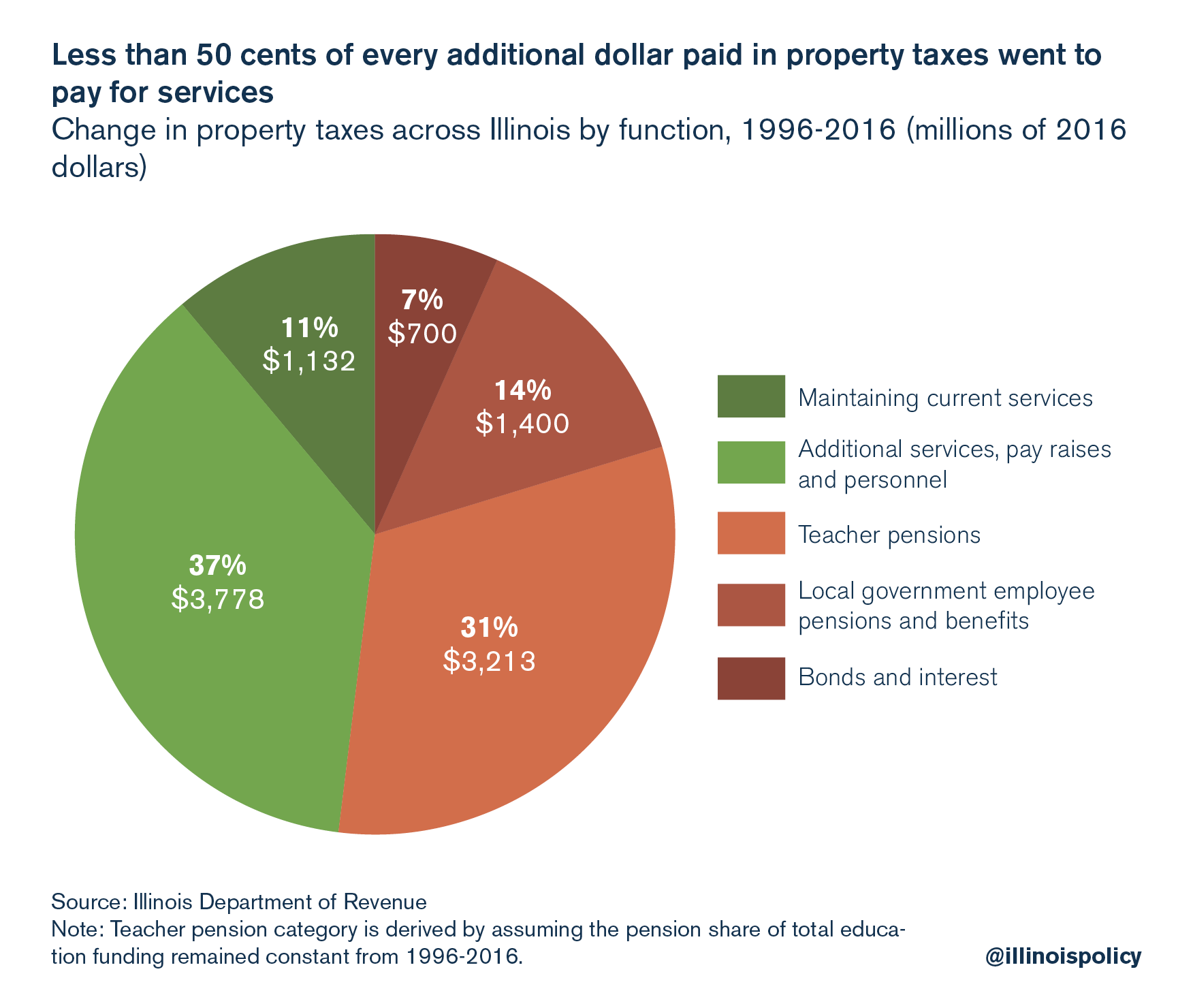

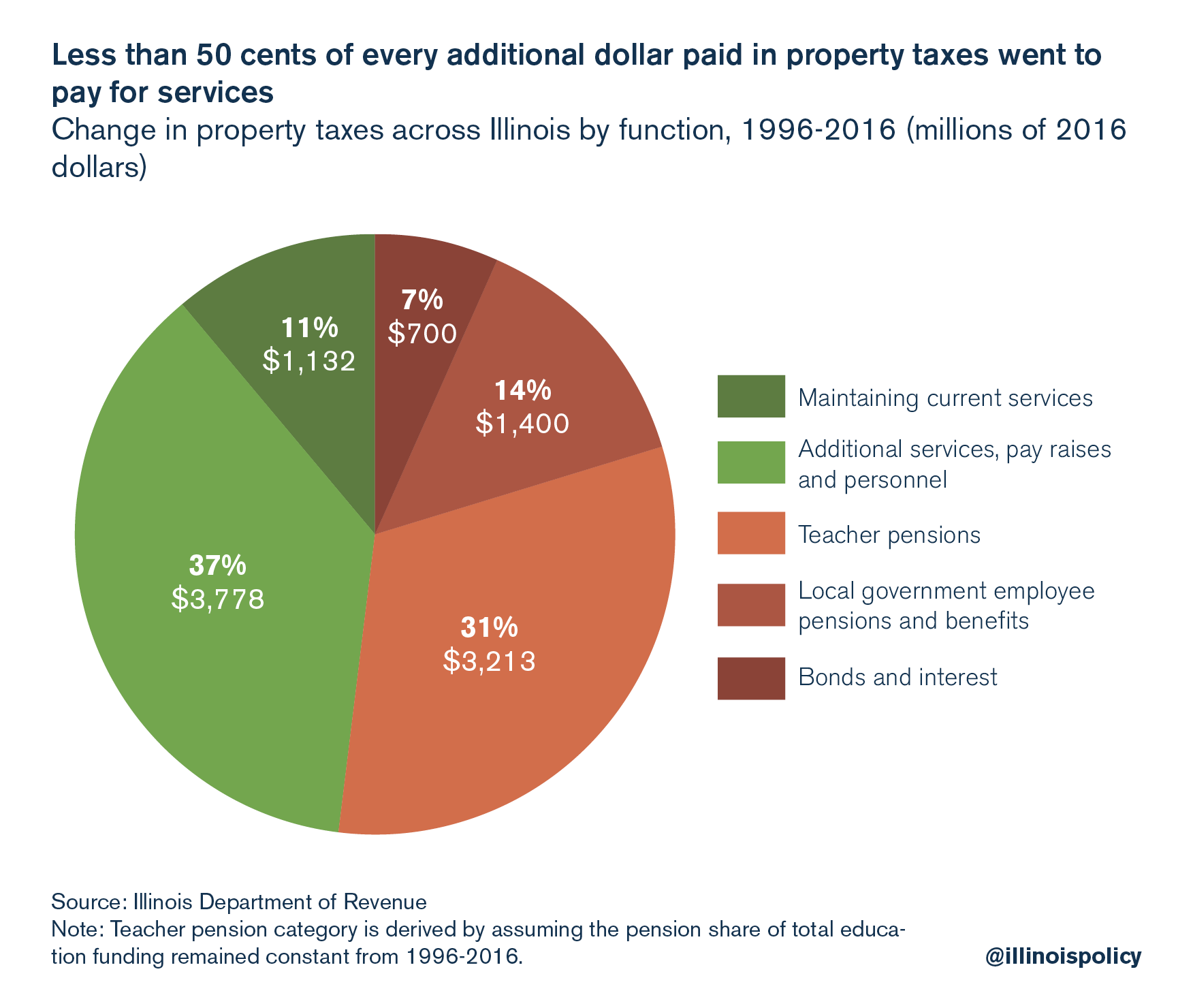

Chicago S High Property Taxes Pay For Squeezed Retiree Benefits Bnn Bloomberg

Investors Exploiting Illinois Property Tax Law At Expense Of Black Latino Communities Study Chicago News Wttw

5225 5253 W Madison St Chicago Il 60644 Loopnet

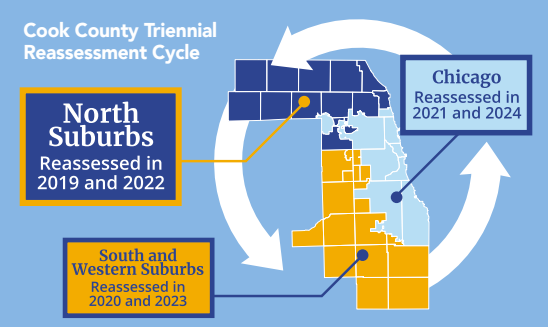

The Cook County Property Tax System Cook County Assessor S Office

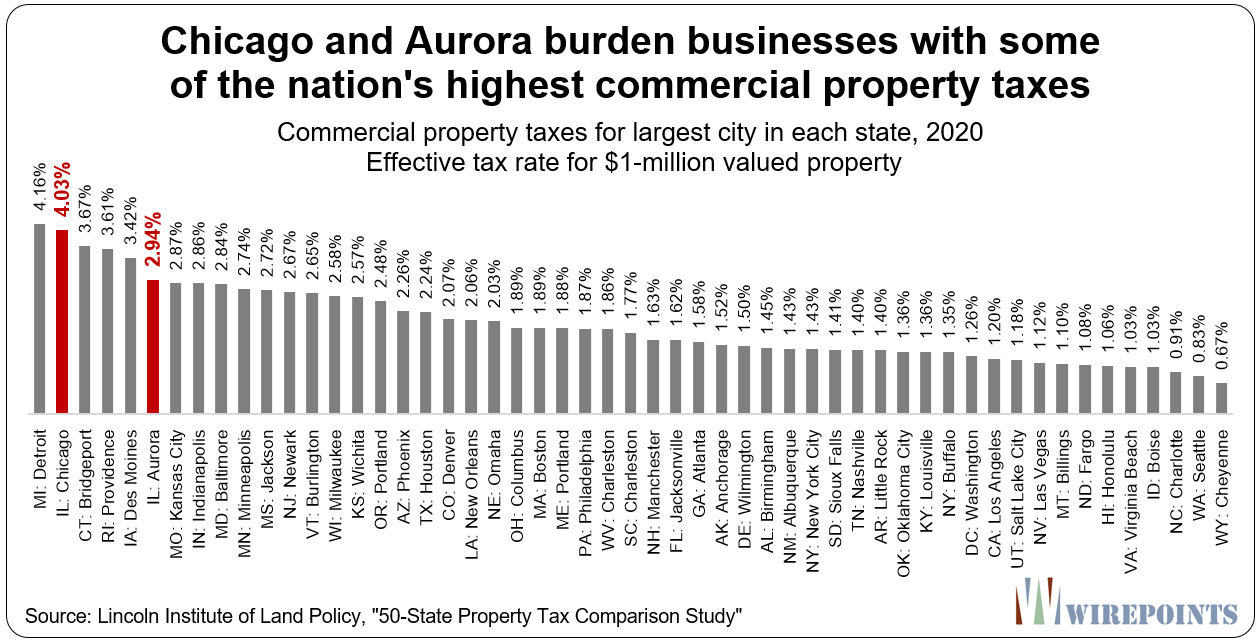

It S Not Just Illinois Homeowners That Suffer Businesses Pay Some Of The Nation S Highest Property Taxes Too Wirepoints Wirepoints

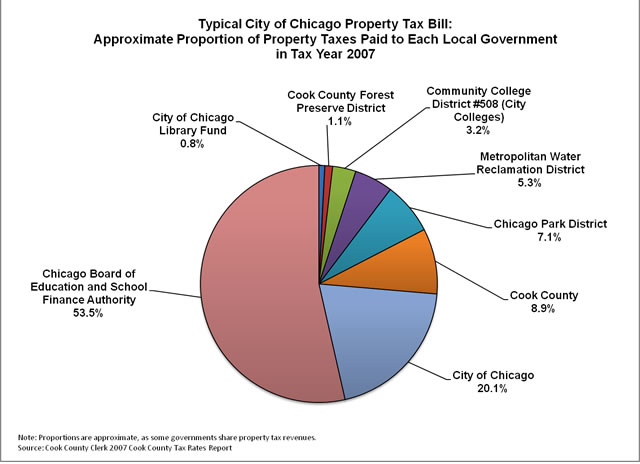

Where Do Your Property Tax Dollars Go The Civic Federation

Cook County Il Property Tax Calculator Smartasset

Lightfoot S Budget Passes 1st Test As Plan To Raise Property Taxes Borrow 660m Advances Chicago News Wttw

Everything You Need To Know About Property Taxes In Illinois

Property Tax Solutions Facebook

Cook County Il Property Tax Calculator Smartasset

Why Private Universities Should 8212 Like The Rest Of Us 8212 Pay Property Taxes Chicago Tribune

Property Tax Burden In The Chicago Region Cmap

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy

How Much Illinois Homeowners Pay In Property Taxes Each Year Chicago Il Patch